Overview

The Problem

I’ve been tasked with creating a MVP (minimum viable product) to offer solutions for the millions of unbanked Americans to help them complete

their necessary finances.

The idea is to quickly and cheaply produce a basic version of the new

product that lets you learn how customers react to it on the market.

User Frustration

Without a bank account, workers cannot cash their checks without heavy

fees, nor build their credit, and simple transactions become complicated.

Project Scope & Constraints

3 week design

Independent case study

Tools: Adobe Creative Cloud, Google Survey, & Notion (file management)

Process

User Centered Design Process

Kickoff

Goals

Understand Target Users

Develop Business Requirements & Project Roadmap

Secondary Market Research

Market Validation

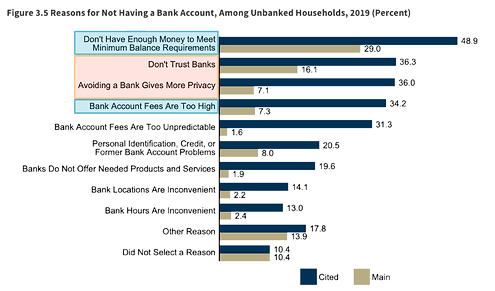

A. Rising unemployment, difficulty accessing credit, & decreased savings

Q. How big is the unbanked market?

A. 14.1 million Americans May 2020

Q. Why will the market grow?

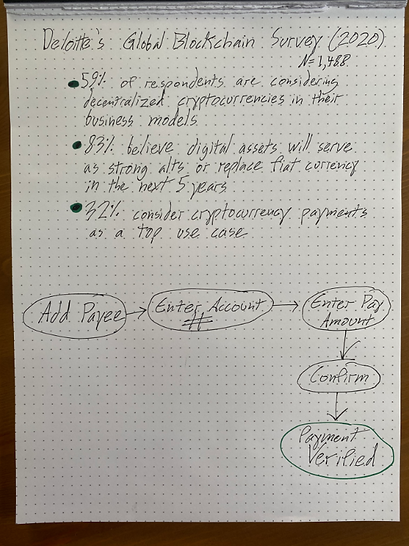

N=1,488

Q. Will users be able to make purchases with cryptocurrencies?

A. 81% of respondents strongly agree that digital assets will be an alternative or replace fiat currency in 5-10 years.

Q. What are the barriers to mass usage?

A. 56% of respondents feel that regulatory barriers will be an obstacle.

N=33,000

Personas

Pay for fast food

Invest/save for the future

Unbanked Goals

Unbanked Gen Z

Doesn't have enough money to meet the monthly balance requirements

Demographics

15 - 24, Texas

Income: less than $15,000

Monthly Income Volatility: varied a lot

Frustrations

Competitive Analysis

Business Requirements

Ensure that users can set up direct deposit from their employers with the app.

Ensure that the app offers a feature to pay monthly bills.

Allow users to buy the major cryptocurrencies.

Allow users to make in-person purchases.

Discover

Goals

Design & Execute User Research Program

Gather Customer Insights

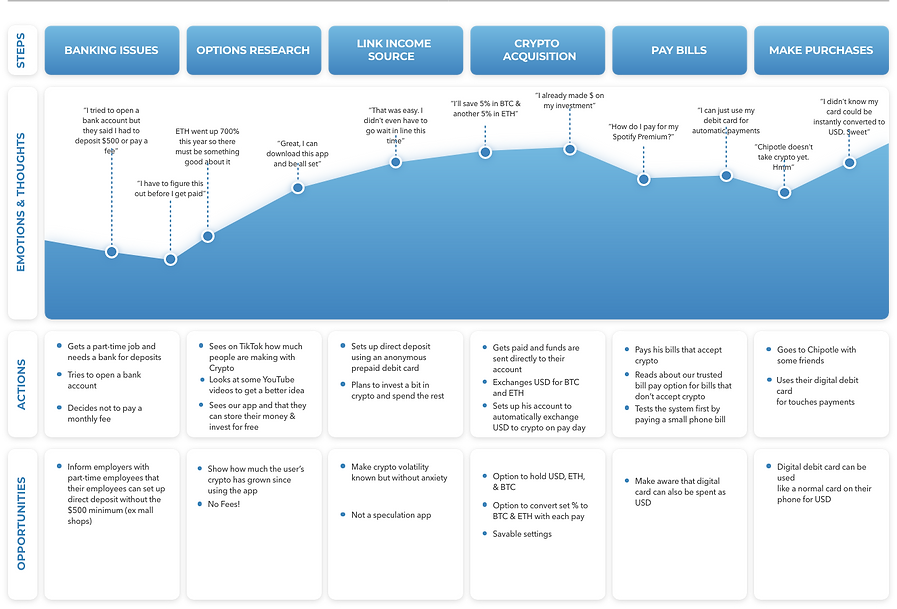

Journey Map

Unbanked Gen Z Journey

Unbanked Millennial Journey

User Survey

(based on user survey)

User Requirements

Add option to order physical card

Add BTC & ETH options to wallet

Evaluate

Goals

Integrate & Analyze Data

Set Foundation for Design

User Flows

Workflow Sketches

Four Step Sketch

Step 1: Notes

Step 2: Ideas

Step 3: Crazy 8's

Step 4: Solution Sketch

Site Map

Design

Goals

Goals

Progress Through Prototyping

Validate Prototypes & Visual Design

Wireframes

Prototype

for quick and clear prototyping

Free UI Financial Kit

V1

Usability Tests

Users were given a scenario and asked to complete four tasks, which were the business requirements

Casual Walkthrough

Confusing icons

Small card info text: accessibility for limited vision

Test 1: 4/4 tasks completed

“a lot of simplicity to it”

“onboarding helped. I remembered the $10”

Test 2: 4/4 tasks completed

Transaction history in the app

Copy & paste option for card information

API to send direct deposit info to workplace

Test 3: 4/4 tasks completed

End-to-end encryption when sending card info

Only relevant search results

Would want more info before buying crypto on the app

Test 4: 4/4 tasks completed

Change “add” debit card to “open”

Order physical card option on creation screen

Send button can be confusing

Test 5: 4/4 tasks completed

Add security options

Better address verification when ordering card

Last pay button to confirm payment button

“I would use this to save time and effort over a bank”

Test 6: 3/4 tasks completed

Option to delete payee once added to saved

Get rid of “x” on the payment verified screen

V2

V3

Divergent Thinking

After a client presentation, the app’s initial framework was simplified and the QR Code functionality received a lower priority to build.

Without the QR code functionality, the app can still pay bills and make in-person purchases with the debit card.

The initial reduction of features aligns the app with a MVP requirement for a quick build and a faster customer reaction on the market.

Business Requirements

Ensure that users can set up direct deposit from their employers with the app.

Allow users to make in-person purchases.

Allow users to buy the major cryptocurrencies.

Ensure that the app offers a feature to pay monthly bills.

Branding

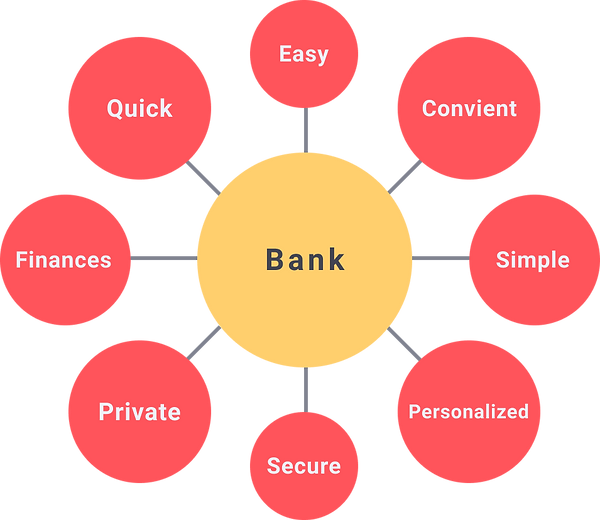

1. Design Touchpoints

Designing the users’ first points of contact by creating relevant, meaningful, and endearing experiences.

2. Mind Mapping

Using keywords from prior research to keep the design in alignment with user expectations

3. Mood Board

via word generator

Light Mode

Dark Mode

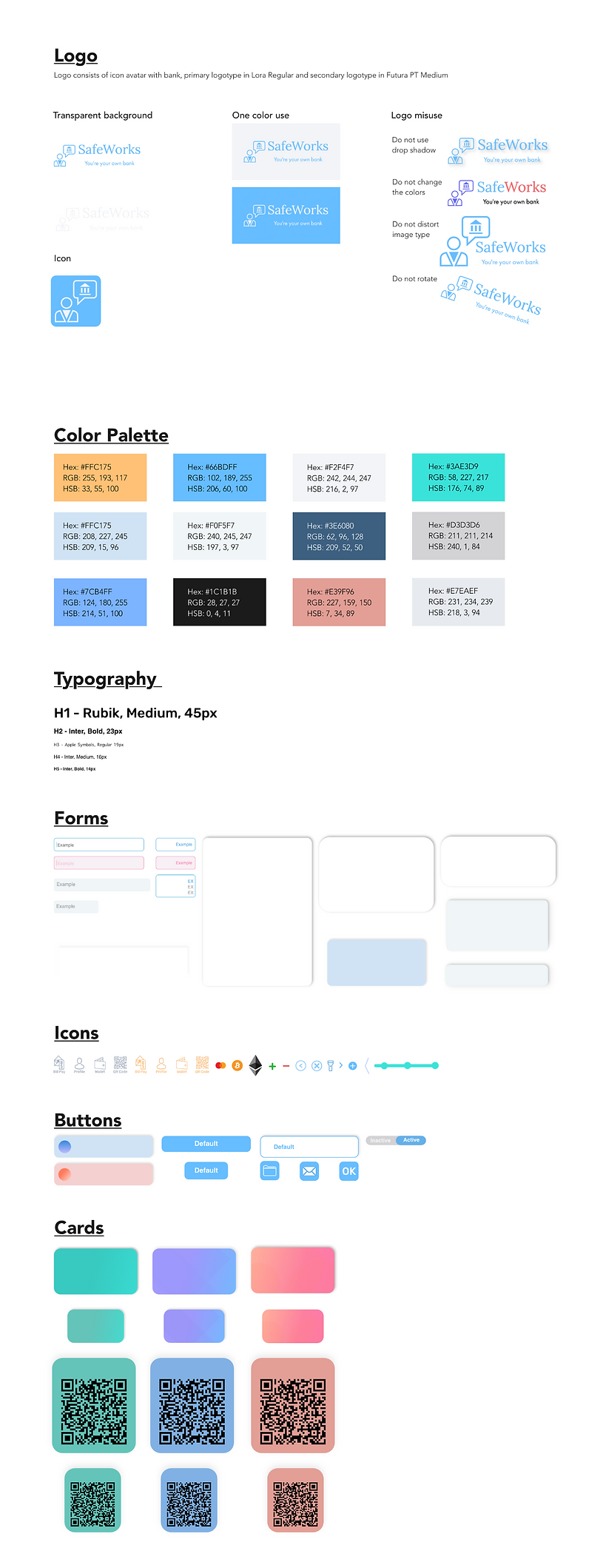

4. Color Palette

via color theory

Light Mode

Dark Mode

5. Accessibility

Deuteranopia, Protanopia & Tritanopia safe

6. Logo

via Adobe Spark

Futura PT: Progressive & Clean

Lora Regular: Reliable & Traditional

Fonts:

Color:

Used by banks to create a sense

of security & trust in the brand.

# 1 preferred color by both men

& women.

7. A/B Testing

A

B

Implement

Goals

Develop initial style guide

Iterative feedback & analysis

Lessons learned

Style Guide

Lessons learned...

Utilize iOS UI Kits for rapid wireframes and high fidelity mockups, so I can focus on user experience, interactions, and flows.

Use Human Interface Guidelines and Material Design to implement mobile best practices.

Rely on the research. Concepts and research that make sense to me, may not be as intuitive to users.

I’m proud of the project because I solved a complex problem of an untapped market of over 14 million users with an emerging technology, being crypto, then made it easy to use and understand.